Eurozone Services and Composite PMI Back in Contraction; Italy, Spain, France at New Lows

Markit Eurozone Services and Composite PMIs show renewed contraction due to drop in services activity, making it extremely difficult to deny that Europe is in a recession. Let's take a look at some numbers.

Markit Eurozone Composite PMI®

Note that prices received fell for the fifth month in six, but prices paid rose for the twenty-seventh straight month.

Let's take a look at the second biggest economy, France, to see what is coming up.

Markit Eurozone Composite PMI®

The Markit Eurozone PMI® Composite Output Index fell from 50.4 in January to 49.3 in February, dropping below the earlier flash estimate of 49.7. The final reading confirmed that business activity contracted in February, having briefly returned to growth in January following four months of decline at the end of last year.Markit Eurozone Services PMI®

Key points:

- Final data confirm slide back into contraction, as drop in services activity offsets marginal rise in manufacturing output

- Strong downturns still evident in Italy and Spain

- Employment and prices charged fall as firms seek to cut costs and win new sales

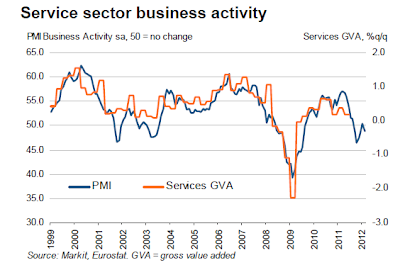

Service sector weakness poses new recession riskProfit Squeeze

Key points:

- Service sector activity contracts for fifth time in six months

- Ongoing fall in new business leads to job losses

- Growth in Germany contrasts with steeper declines in Italy and Spain

- Business confidence hits seven-month high

Of the four largest euro countries, only Germany showed expansion in February, and the rate of growth slowed from January’s seven-month high. The French service sector stagnated, ending a two-month period of mild expansion. Both Spain and Italy registered steep contractions, with the rates of decline gathering momentum in both cases.

Nations ranked by business activity (February)

- Ireland 53.3 12-month high

- Germany 52.8 2-month low

- France 50.0 3-month low

- Italy 44.1 4-month low

- Spain 41.9 3-month low

Spanish service providers reported a further particularly steep drop in payroll numbers, and employment also fell sharply in Italy’s service sector. French headcounts rose only slightly, while services employment growth in Germany slowed to the weakest since June 2010.

Companies frequently sought to boost sales by cutting prices, and average prices charged for services fell for the fifth time in the past six months as a result. Price trends varied markedly by country, however, ranging from ongoing upward pressure in Germany to steep falls in Spain and, to a lesser extent, Italy. France registered a slight fall in prices charged for services, reflecting the stagnation of new business flows in February.

In contrast to the trend for charges levied by service providers, input prices in the sector rose for the twenty-seventh straight month, pushed up in many instances by higher fuel and energy prices.

Note that prices received fell for the fifth month in six, but prices paid rose for the twenty-seventh straight month.

Let's take a look at the second biggest economy, France, to see what is coming up.